salt tax cap news

In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. December 12 2021 930 AM 4 min read.

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bnn Bloomberg

The state and local tax deduction cap commonly known as SALT was enacted as part of President Donald Trumps 2017 tax reforms.

. On Tuesday November. Applying to tax year 2023 for returns filed in 2024. The SALT deduction applies to property sales or income taxes already paid to state and local governments.

Polls Open at 600 am. It limits state and local tax deductions to 10000 per return for single filers and 5500 for married. Second the 2017 law capped the SALT deduction at 10000 5000 if.

The SALT deduction benefits only a shrinking minority of taxpayers. News News Based on facts. But you must itemize in order to deduct state and local taxes on your federal income tax return.

PISCATAWAY NJ Polls will be open in New Jersey from 600 am. 2018 analysis showed 752000 Californians earning less than 250000 a year paid an additional 1 billion in federal taxes thanks to the SALT cap. The new tax law created the State and Local Tax SALT cap in 2017.

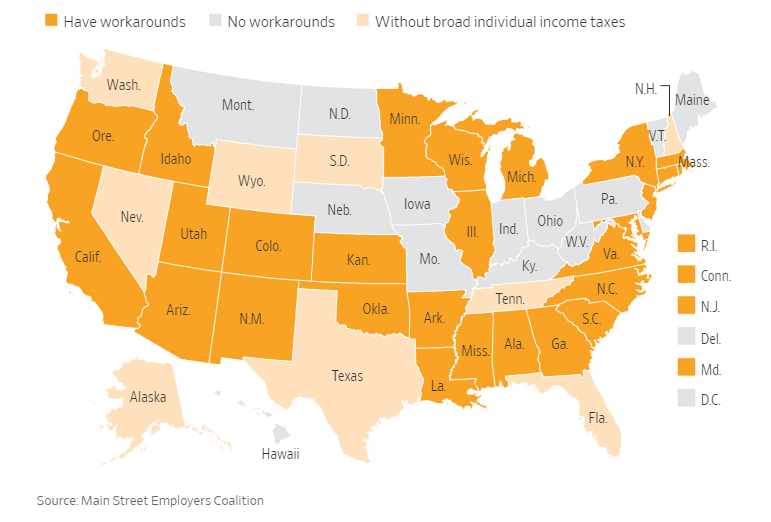

Pass-through business owners in a growing number of states may take advantage of entity-level state tax elections as a measure of relief from the 10000 federal deduction. On this website you will find information about Massood Company PA CPAs including our list of services. For the 2022 General Election.

Todays announcement does not affect state tax refunds received in 2018 for tax returns currently being filed. Tom Suozzi D-NY speaks during a news conference announcing the State and Local Taxes SALT Caucus outside the US. Before the creation of a cap on this deduction 91 of the benefit.

Taxpayers can deduct up to 10000 of. 455 Hoes Lane Piscataway NJ 08854 Phone. Local newspaper covering news sports police fire and government issues for Piscataway NJ 08854.

12There has been a lot of discussion amongst government leaders about the cap on state and local tax SALT. We have also provided you with online resources to assist you in the tax. The Tax Cuts and Jobs Act TCJA enacted in December 2017.

Capitol on April 15 2021. The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a.

Study Finds Salt Deduction Cap Graduated Income Tax Will Combine To More Than Double Tax Burden On Some Households Economic Opportunity Latest News

Coping With The Salt Tax Deduction Cap

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

Us Supreme Court S Failure To Repeal Salt Deduction Cap Frustrates Nj Residents Youtube

S Corp Joins Salt Parity Panel Discussion The S Corporation Association

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Local House Members Including Republicans Pushing To Change Key Part Of Trump Tax Law Orange County Register

U S Lawmakers Propose Bill To Kill Salt Tax Cap

Democrats Salt Headache Hangs Over Budget Reconciliation Bill Roll Call

News Archive Page 2 Of 5 Dannible And Mckee Llp

Bill Would Allow S Corps Partnerships To Avoid Salt Cap On Tax Deductions Arkansas Business News Arkansasbusiness Com

Salt Cap Repeal Salt Deduction And Who Benefits From It

Salt Parity Archives The S Corporation Association

A Sprinkle Of Compromise To Appease Critics Of The Salt Cap

Millionaire Sounds Off On Calls To Lift Salt Deduction Cap Itep

Changes To The State And Local Tax Salt Deduction Explained

Democrats Say Tax The Rich But Mean Tax Breaks For The Rich Ways And Means Republicans

Salt Deduction Cap Democrats Go To Bat For The Wealthy Bloomberg